In today’s dynamic work environment, financial security is paramount. One of the essential tools for ensuring a stable financial future is the Universal Account Number (UAN). If you’re an employee in India, understanding and managing your UAN can significantly contribute to your long-term financial well-being. Let’s delve deeper into what UAN is, its significance, and how it can empower you to take control of your financial journey.

What is UAN?

UAN, short for Universal Account Number, is a unique identification number assigned to every employee contributing to the Employee Provident Fund (EPF) in India. It serves as a centralized umbrella for linking multiple EPF accounts held by an individual throughout their career. The UAN remains constant, irrespective of changes in employment, simplifying the EPF management process for both employers and employees.

Importance of UAN:

- Portability: UAN facilitates the seamless transfer of EPF funds when an employee changes jobs, ensuring continuity in retirement savings.

- Consolidation: With UAN, individuals can consolidate multiple EPF accounts under a single umbrella, streamlining fund management and reducing administrative hassles.

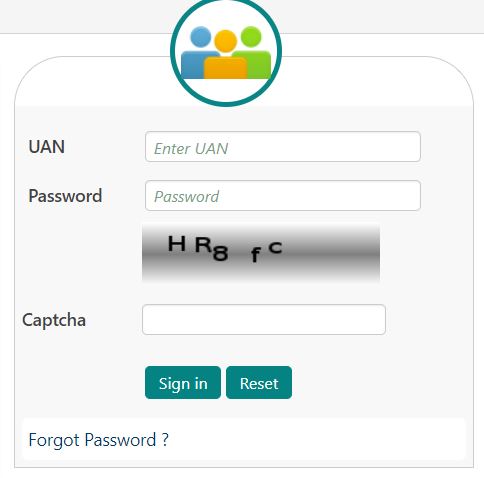

- Access to Services: Through the UAN portal, employees can access various EPF services online, such as checking account balance, downloading the EPF passbook, updating personal details, and initiating claims.

- Transparency: UAN promotes transparency in EPF transactions by providing real-time access to account-related information, empowering employees to monitor their contributions and interest accrual.

How to Find Your UAN:

- Check Salary Slip: UAN is typically mentioned on your monthly salary slip provided by your employer. Look for a 12-digit number labeled as UAN.

- Ask HR Department: If you can’t locate your UAN on your salary slip, reach out to your company’s HR department. They can provide you with your UAN.

- Visit EPF Portal: Alternatively, you can visit the EPF member portal and use your EPF account details to ascertain your UAN.

Conclusion:

In essence, UAN is a powerful tool designed to simplify EPF management and empower employees with greater control over their retirement savings. By understanding and leveraging your UAN effectively, you can ensure financial security and peace of mind both during your working years and after retirement. Take proactive steps to know your UAN and unlock its benefits to embark on a journey towards a financially secure future.

By prioritizing your understanding of UAN and its role in EPF management, you’re laying a solid foundation for financial stability and prosperity. Stay informed, stay empowered, and embrace the opportunities that UAN offers for securing your financial future.